According to official sector statistics processed by the CONFINDUSTRIA MARMOMACCHINE Studies Center, from January to August 2022 Italy’s overall exports of marbles, travertines, and natural stones generally increased in value by 14.3% from the same period the previous year, reaching worth of 1.394 million euros. Although slightly less than the figure for the first half of the year (which registered a 17.7% increase), this shows continuity with the growth trend seen last year (+20.8% from 2020), which had already made it possible to fully recoup the pre-pandemic export level (a +1.9% difference from 2019).

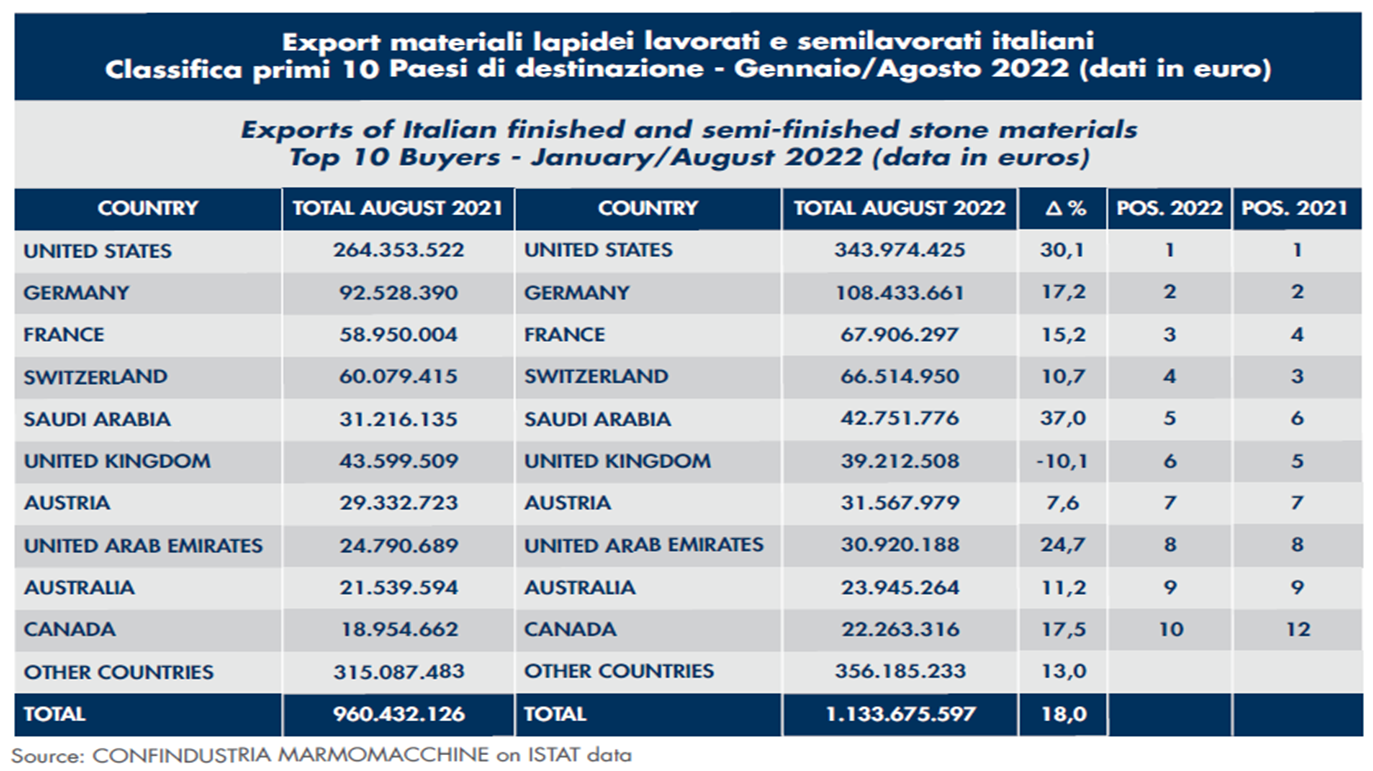

Analyzing the composition of Italy’s stone sector exports, we see that a fundamental contribution to growth came from finished and semi-finished materials, whose foreign sales in the first 8 months of 2022 increased by 18% from the same period in 2021, for a total of 1,133.7 million euros. We remind readers that finished products, in addition to being the ones with highest added value, have traditionally accounted for three-quarters of the total value of Italian stone exports, with a share that in 2022 reached 81.3%. Remaining essentially on the good levels of 2021 (+0.6%) were exports of raw materials, worth 260.3 million.

With regard to export markets, according to the CONFINDUSTRIA MARMOMACCHINE statistical report, from January to August 2022 the top buyer of blocks of marble, granite and natural stones extracted in Italy was China which – although backsliding by 8.9% from the record levels registered in 2021 – totaled 126.5 million in imports (or 50% of Italy’s total raw exports), followed by a rebounding India (+90.9%) with 32 million.

As for the finished and semi-finished products sector, the excellent health of the US market – up 30.1% from the first 8 months of 2021 – confirms its undisputed leadership among destination markets with purchases worth 344 million euros or 30.3% of the total value of Italy’s exports of slabs and finished goods.

It should be emphasized that there was also a heavy increase in sales to Italy’s major European trading partners, above all to Germany (second buyer with 108.4 million in imports, + 17.2%), France (third with 67.9 million, +15.2%), Switzerland (fourth with 66.5 million, +10.7%) and Austria (seventh with 31.6 million, +7.6%) while there was a notable downturn in imports by the United Kingdom (-10.1%) although with purchases worth 39.2 million euros it was still the sixth-ranking buyer.

Extremely positive was the export trend for finished stone products Made in Italy to the Persian Gulf area, in particular to Saudi Arabia (fifth with 42.8 million, +37%) and the United Arab Emirates (eighth with 30.9 million, + 24.7%). Concluding the top ten buyers ranking were two other non-EU countries, Australia (ninth with 23.9 million, +11.2%) and Canada (tenth, with 22.3 million, + 17.5%).

The figures for the first 8 months of 2022 therefore confirm a generalized growth in Italy’s exports to almost all the major reference markets for stone products. While it is difficult to make predictions in a complex context like the one that companies are currently experiencing, in light of the critical points that emerged in the second half of the year – like the explosion of production factor costs and record energy prices – it is nonetheless licit to expect an attenuation of this positive trend in the final quarter of the year, although this should not prevent the Italian stone sector from ending 2022 with increasing foreign revenue for the second consecutive year after the losses of 2020.

Comments are closed.