In 2021 the worth of Italy’s exports of machines, installations, tools and other equipment to extract and process natural stones rose by 18.5% from the previous year, reaching 1 billion 107.1 million euros. This was certified by official sector figures processed by the Confindustria Marmomacchine Studies Center and presented at the association’s General Assembly held on June 10 in Milan. They show that – in line with the trend already evident in previous quarterly statistics – the Italian techno-stone industry fully recouped its levels of pre-pandemic exports (+0.3% from 2019) after 2020 had ended with a loss of 15.4%, taking sales – for the first time since 2013 – below the billion-euro mark, and specifically to 926 million.

It should be mentioned that in the second part of the year there was a “normalization” of the growth curve after it had reached +38.8% in the first half, a figure distorted by the low sales volumes sector companies had registered in the spring of 2020 when lockdown halted production.

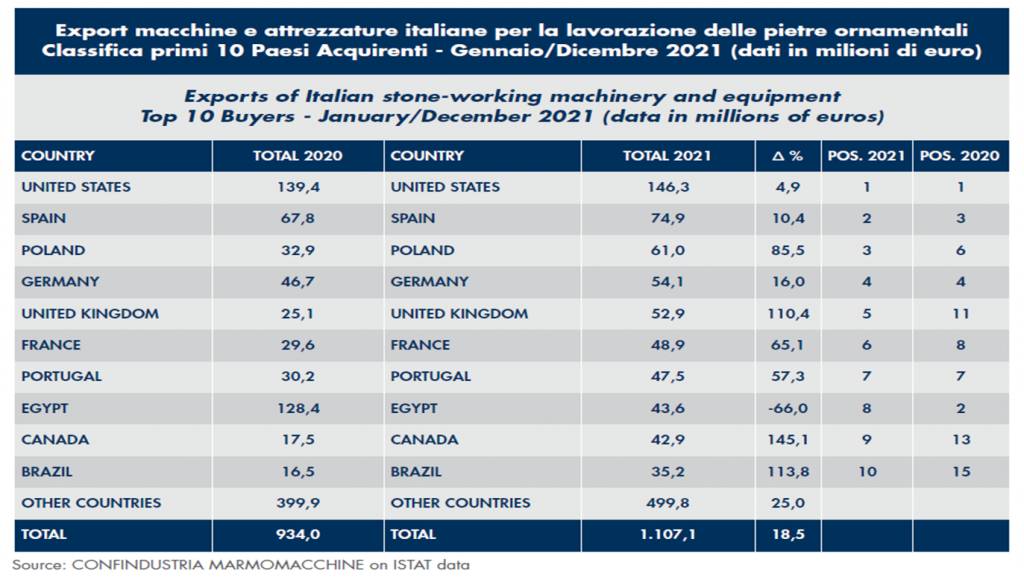

If we look at the top ten buyers of machinery and equipment Made in Italy, in first place we find the United States again, whose imports in 2021 grew by 4.9%, reaching 146.3 million euros. Next came Spain, in the number-two slot, with 74.9 million (up 10.4%) and Poland which, with an excellent +85.5%, rose to third (61 million). There was also good growth on other major European markets: +16% in Germany (ranking fourth with 54.1 million), +110.4% in the United Kingdom (fifth with 52.9 million), +65.1% in France (sixth with 48.9 million) and +57.3% in Portugal (seventh with 47.5 million). Among destination countries outside Europe, Italian stone technology sales saw a considerable downturn in Egypt (-66%, in eighth place with 43.6 million – a downsizing after heavy increases in recent years) but excellent upturns in both Canada (+145.1%, ninth with 42.9 million) and Brazil (+113.8%, in tenth place with 35.2 million).

According to data processed by the association’s Studies Center, the upward trend in the Italian techno-stone sector was also seen in figures for the first quarter of 2022, with foreign sales gaining 3.4%. While waiting to see what impact the current international situation will have on the export picture, this data in any case photographs a solid sector that, thanks to excellent resilience and outstandingly widespread exports last year was able to show double-digit growth and return to pre-pandemic levels, consolidating its strong international vocation (with exports in 2021 accounting for 75.6% of total sector revenue).

Comments are closed.